A child’s curiosity and natural desire to learn are like a tiny flame, easily extinguished unless it’s protected and given fuel. This book will help you as a parent both protect that flame of curiosity and supply it with the fuel necessary to make it burn bright throughout your child’s life. Let’s ignite our children’s natural love of learning!

March 30th, 2007

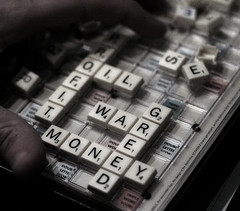

The Dollar and the Death Knell

In recent years (and decades) we have seen bold, invasive military action promoted in the name of securing our “national interests”. Ron Paul, in his excellent speech (which you must read if you’ve yet to do so) titled “The End of Dollar Hegemony”, discusses how those national interests are often tied to protecting the strength of the dollar:

Most importantly, the dollar/oil relationship has to be maintained to keep the dollar as a preeminent currency. Any attack on this relationship will be forcefully challenged — as it already has been.

In November 2000 Saddam Hussein demanded Euros for his oil. His arrogance was a threat to the dollar; his lack of any military might was never a threat. At the first cabinet meeting with the new administration in 2001, as reported by Treasury Secretary Paul O’Neill, the major topic was how we would get rid of Saddam Hussein — though there was no evidence whatsoever he posed a threat to us. This deep concern for Saddam Hussein surprised and shocked O’Neill.

It now is common knowledge that the immediate reaction of the administration after 9/11 revolved around how they could connect Saddam Hussein to the attacks, to justify an invasion and overthrow of his government. Even with no evidence of any connection to 9/11, or evidence of weapons of mass destruction, public and congressional support was generated through distortions and flat out misrepresentation of the facts to justify overthrowing Saddam Hussein.

There was no public talk of removing Saddam Hussein because of his attack on the integrity of the dollar as a reserve currency by selling oil in Euros. Many believe this was the real reason for our obsession with Iraq. I doubt it was the only reason, but it may well have played a significant role in our motivation to wage war. Within a very short period after the military victory, all Iraqi oil sales were carried out in dollars. The Euro was abandoned.

In 2001, Venezuela’s ambassador to Russia spoke of Venezuela switching to the Euro for all their oil sales. Within a year there was a coup attempt against Chavez, reportedly with assistance from our CIA.

After these attempts to nudge the Euro toward replacing the dollar as the world’s reserve currency were met with resistance, the sharp fall of the dollar against the Euro was reversed. These events may well have played a significant role in maintaining dollar dominance.

In light of such a perspective, it is interesting to note that, as this Al Jazeera article explains, other countries are seeking to diversify their assets and get rid of their dollars:

Gulf economies will move away from a dollar currency peg and shift foreign exchange reserves away from dollar to other currencies, including the Chinese yuan, the chief executive of Dubai International Financial Centre (DIFC) has said.

Nasser al-Shaali noted that the UAE central bank had already started buying euros – part of its strategy to move about 10 per cent of its reserves into the single European currency before the end of the year.

Not surprising (especially in light of recent conflicts and pressure with Iran) is the revelation that China is also paying for Iranian oil in euros:

China’s state-run Zhuhai Zhenrong Corp, the biggest buyer of Iranian crude worldwide, began paying for its oil in euros late last year as Tehran moves to diversify its foreign reserves away from U.S. dollars.

As Rep. Paul masterfully explains in his speech, a death knell sounds off (secretly, of course… one wouldn’t want the public to be informed on such matters) when anybody tries to abandon the dollar. The government’s creation of money by fiat is an illusion that, amazingly, has persisted even this long. Like many other government promises, the one stipulating the (rapidly devaluating) value of your “currency” is backed not by precious metals or other objects of intrinsic value, but by a gun. Uncle Sam says that your Federal Reserve Note is currency, and so be it. Anybody who disagrees gets a prescription of “shock and awe”.

The adage “it’s all about the money” is truer than most seem to believe.

10 Responses to “The Dollar and the Death Knell”

Leave a Reply

You must be logged in to post a comment.

Connor, I remember when the “death of the dollar” was predicted back in the 60’s, when I was in college. I think some people have been making this prediction for decades, and yet it hasn’t happened.

I asked my son (40-ish now) about this continuing fear, and he replied,

Now, if the Brethren speak up in General Conference this weekend, and advise us to invest in Euros, I am ready to revise my opinion immediately! 🙂

I think some people have been making this prediction for decades, and yet it hasn’t happened.

Indeed. This fact is often cited as an argument against any future economic collapse and dollar deflation. Like many other things, I feel that such an economic shift will come as a thief in the night. What really is an economic collapse will (and has for several decades) been ocurring slowly (but surely). Our dollar is at 4% of its original value, and inflation (with resultant price inflation) is astronomical. The national debt continues to soar, new currency is printed unabated, Americans are indebted as never before, and our enemies hold the flaxen cord of our foreign debt.

If and when there is economic turmoil, most will think that there is nothing wrong. Why? Because the government doesn’t want to collapse. They want to keep paying their bills. To do that, they simple print more fiat currency, creating it out of thin air. They flood the market with new dollars, which diminishes the purchasing power of all other money in circulation. This has been going on for decades, and it has destroyed the power of the dollar. There will come a point (and I think the time is not that far off) when the dollar will either be replaced (there are already talks of an “amero”), eliminated (in favor of digital currency, as has been suggested), or devalued to the point of oblivion.

At first most people will not notice economic trouble. Just as the government currently touts us having a strong economy, they will continue to parrot the idea that “all is well”. Banks will (wherever possible) continue to promote easy mortgages and home “ownership”, tying people into further debt. More money will be flooded into the economy to give a false impression that there is enough to go around, but as they do that your savings is depleted through inflation.

Now, if the Brethren speak up in General Conference this weekend, and advise us to invest in Euros, I am ready to revise my opinion immediately!

It is my belief that this will never happen. We’ve been counseled numerous times to get out of debt. Part of that strategy might very well be investing in sources not backed by the fiat dollar. The Prophet is not a financial counselor, just as he is not a political scientist. The same neutrality we see in the political realm by church leaders will be practiced to a large extent in the economic realm, I believe. We are counseled to save, store, and get out of debt. Those who have ears to hear, will, in opinion, distrust the dollar as a method of savings and future economic security.

The brethren will NOT talk about the Euro or the SPP in conference. Neither will our elected representatives. To wait for someone to speak out on such matters is ill-advised.

We are so insulated as Americans to the value of our dollar. We mistakenly go on living believing all is well, because we still can buy our stuff. But, I am more than a little concerned because I have seen my dollar grow more and more worthless since the “financially responsible” Republicans have taken over. In October of 2001, I travelled to Europe, and the Euro was just being introduced. My dollar bought me 1.15 Euros. Again in summer of 2004, I travelled again to Europe, and my same dollar only bought 0.85 Euros. Today, if you look at the exchange rates, my dollar would only buy me 0.748 Euros. So, within the space of about 6 years, my dollar is actually worth about 40% less! (As our dollar becomes more and more worthless, it costs us more dollars to buy our imported oil, gas, cars, IPods, etc.)

So, I am concerned that our economy is going to go belly-up, partially because I can read the scriptures. You ought to study the whole chapter of Revelation 18. After studying that chapter, I wonder if you will then be able to proclaim All is Well in Zion.

I agree that the Brethern are unlikely to give specific financial guidance, Connor.

In the latest information, recently updated on the Internet, about family preparedness, the advice is very simple: Have enough drinking water to last through a temporary disruption of delivery; build up a three-month supply of everyday food; “For longer-term needs, and where permitted, gradually build a supply of food that will last a long time and that you can use to stay alive, such as wheat, white rice, and beans;” and finally, “Establish a financial reserve by saving a little money each week and gradually increasing it to a reasonable amount.”

As befits a word-wide church, the financial advice is very generic, and thus is useful to everyone, no matter where they live, or how much income they have.

You may well be right about imminent demise of the dollar, Connor. I certainly believe that is is wise to have diversified assets. I guess I would worry more about the dire predictions now if I hadn’t been reading different versions of them for over forty years.

RoAnn, even more confusing to me has been my observation that the church now places LESS emphasis on these basic principles of provident living (food storage, debt) than in years past. I imagine we will not hear very many references to provident living this weekend in GC. I have talked to a number of Stake Presidencies and Bishoprics about this very subject. I asked them when a new convert to the Gospel was supposed to be introduced to the concept of home storage and production. There SEEMS to be an agreement among many that these issues are supposed to be preached on a local level as fits the situation. Some countries have laws against food storage, some wards are singles or young adult wards, etc. This seems consistent with our Church becoming a world-wide church.

The Church has not abandoned these doctrines, though. You were wise to visit the Church’s website for more guidance. We each as Saints need to assess our own individual situation and see if we are living providently in accordance with the Church’s general principles of welfare.

Kelly (#3) I would certainly never say, “all is well in Zion,” or even in the U. S.

However, I have lived in 11 different countries over the last forty-five years, and have seen the dollar gain and lose value many, many times vs. other currencies. Those fluctuations are historically quite common. Sometimes I think we tend to remember when we travel and find things expensive elsewhere, and forget about all the “bargains” we purchased at other times. 🙂

Remember a few years ago when we were told by some that Japan was going to overtake us economically? Then came their serious financial problems. Now there are predictions that Japan will be in dire straits soon because their birth rate is below replacement level, and there will be fewer and fewer workers to support an increasingly aging popluation.

Europe will be facing similar problems, complicated by an increasing Muslim percentage in their population.

All is not well in the rest of the world, either. So the dollar may be able to keep pace with the Euro in the long term, after all.

The countries I now most see mentioned as real economic long term threats to the U.S. are China and India. There are so many variables to consider regarding those two countries that it’s hard to say how things will sort out in the next few years.

We bought some gold as a hedge against inflation many years ago. It has kept pace, but not done as well as most of the stocks we purchased. Diversification in stocks, bonds, and real estate still seems like good investing advice to me.

RoAnn, interesting observations you make. The threats you point out from India and China are some I don’t have direct experience with, like I have with Europe. You are correct about currencies fluctuating, and the reason that the dollar has not lost even MORE value against the Euro in the past 6 years is because the European economy is also hurting. It’s just that Europe’s economy is not sliding as fast as USA’s economy. In reality, I think it’s correct to say that India’s and China’s economies are playing a role against both ours and Europe’s.

All just further evidence of wisdom in the Church’s doctrines of getting our houses in order. Also all just further evidence for Connor’s argument that our fiddling with the Middle East is really only an effort to keep our dollar hegemony.

Gold is aproaching an all time high because people are scared the dollar is going to crash. Isn’t this similar to what happened in 1979? I hope the dollar sticks around. I don’t want to know what’s going to happen to the world’s economy if the dollar crashes. However, the federal reserve has recently made the decision to no longer publish the amount of dollars it prints yearly (will no longer publish m3). With news like that, there’s no stopping the inflation rate. I guess all I have to say is that I wouldn’t be surprized if the dollar goes way down south over the next 20 years.

Then Iran is ripe for attack after this bit of news:

http://www.tradearabia.com/news/newsdetails.asp?Sn=ECO&artid=121120

Good article, Curtis. From your blog I also stumbled upon this article which discusses much of the same thing. It’s now only a matter of time before we intervene..